Measuring Economic Activity in the Presence of Superstar MNEs

Abstract

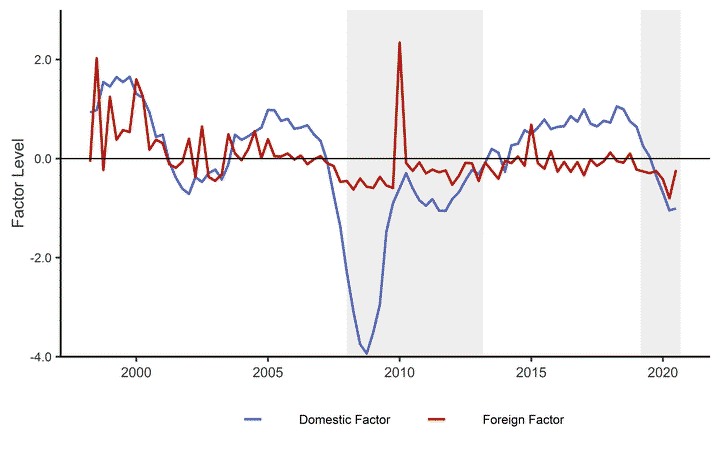

In 2015, the Irish economy experienced a 25 percent annual increase in GDP, driven largely by the repositioning of multinational enterprises' intangible assets and their associated revenue streams. We address these distortions in assessing the state of the domestic Irish economy by utilizing a two-step dynamic factor model. We find that real output in Ireland is heavily inflated by the presence these intangible assets and their associated tax minimization schemes. We use our findings to assess the state of the domestic economy and gauge its fiscal position among EU27 member states.

Economic Letters (2023), Vol. 226